Marriage, or childbirth, Dhanteras or Akshya Tritiya—no matter the occasion—we dare not celebrate it without gold, the go-to investment.

From brides donning gleaming jewels on their special day to families passing down cherished heirlooms, Indians have an unbreakable bond with gold. Each piece carries precious memories and a sense of belonging. Wear it, gift it, or just stock it; we can’t get enough of this dazzling, blingy splendor.

Isn’t it obvious when your mother associates you with gold when you are at your best behavior? There could be linguistic differences from “Sone ki chaand” of Mumbai to “Ponnum kudam” of Cochin or “Na koduku bangaram” of Hyderabad, but the emotion remains the same.

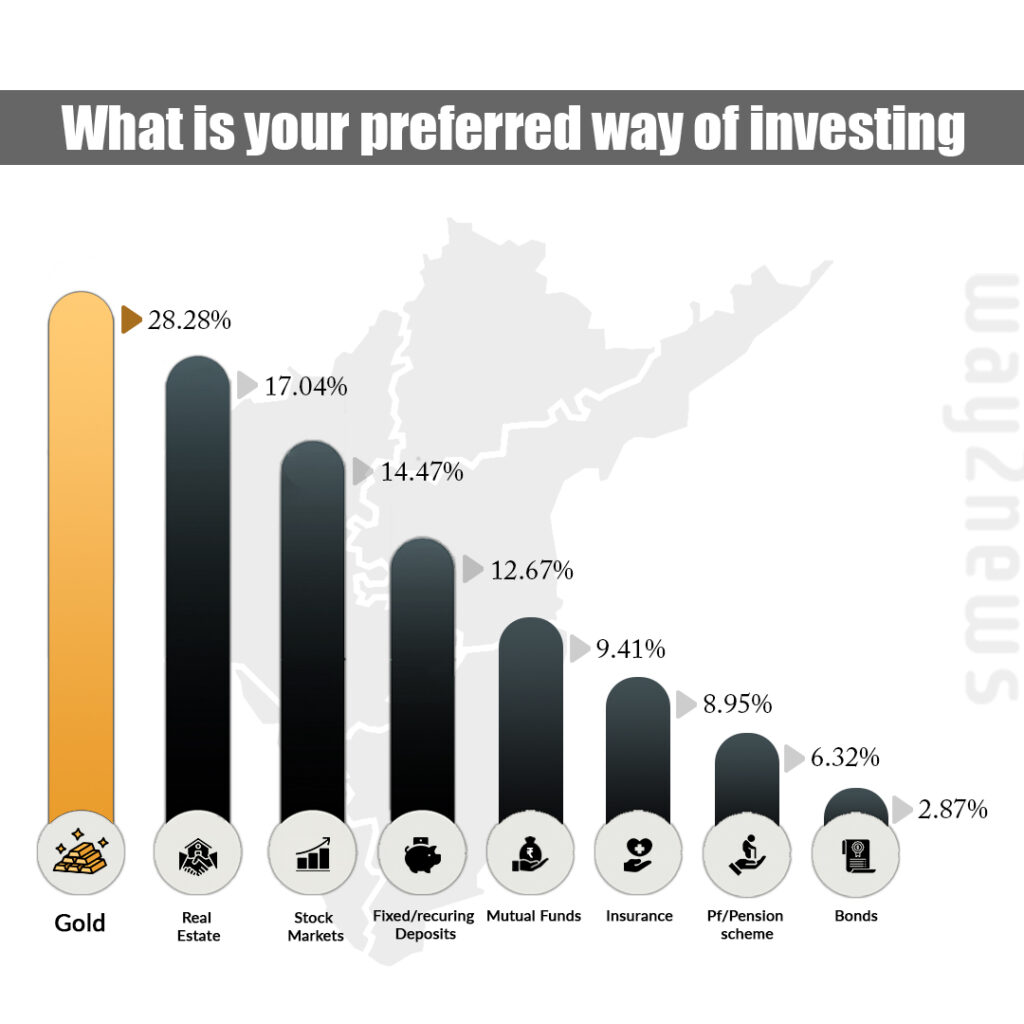

But flipping the pages from mothers to ours, gold did lose its allure among the great Indian Goldaholics, with a 7% drop in demand in the second quarter of 2023 compared to the previous year. To delve deeper into this transition, Way2News conducted a comprehensive survey among 4.5 lakh South Indians to understand their preferred savings options. The findings underscore that gold continues to reign supreme in South India as the preferred choice for savings and investment.

Oh boy! We are sold on Gold

Gold ornaments were traditionally given to daughters as a form of insurance to be redeemed in difficult times. One’s social standing and reputation in the community were based on their possession of gold. Moreover, South Indians take pride in wearing gold as a way to express our identity and fashion statement.

Gold has been a trusted store of value for centuries, and it was believed that investing in gold is a safe and secure way to protect their wealth. Unlike currencies or paper assets, gold is a tangible asset that retains its value even during economic downturns.

One of the key factors driving this trend is the perception that gold is a safe and reliable investment. South Indians view gold as a tangible asset that can be easily liquidated in times of need. Unlike stocks or bonds, which can be volatile, gold is considered a stable and secure investment. It is a timeless form of wealth that has retained its value over centuries.

Why Not Others?

According to the survey, around 28% of South Indians prefer to invest in gold over other savings plans. This is a remarkable figure, considering the plethora of investment opportunities available in the modern world. Even though the price of gold can be hauntingly high, people in South India continue to embrace it as their go-to investment.

Even with the changing landscape largely favoring other investment options, why are other financial avenues, despite their inherent strengths, often finding themselves overshadowed by the radiant allure of gold?

Real estate, chosen by a measly 17.04% of survey participants, is apparently considered a global investment staple, but for South Indians, it’s just too much of a burden with all those pesky management and maintenance responsibilities contrasting with gold’s simplicity and portability, making gold a favored choice. The stock market, polled 14.47% of respondents, can seem unpredictable and intimidating. Gold, in contrast, offers a comforting stability and tangible allure, aligning with South Indians’ appreciation for tradition and timeless value.

Fixed deposits, with their safety and assured returns, seem to be the choice of around 12.67% of respondents. But South Indians, renowned for their financial acumen, apparently find the idea of waiting for modest returns rather unappealing. Gold combines financial security with the allure of ornate jewelry and the promise of substantial returns, making it a more appealing choice.

9.41% believes in the investment possibilities of Mutual funds that offer diversified portfolios. Mutual funds may seem like a sensible choice for some, but for those who prefer their investments to be tangible, gold wins the day as it delivers a more personal and emotionally satisfying investment experience. Insurance and Provident funds (PF), clocking in at 8.92% and 6.32%, respectively, respectively, undeniably provide long-term security. However, the gradual accumulation and limited control over finances keep PF options on the back burner, as South Indians believe gold can offer quicker and more flexible returns.

A Relation crafted in Gold

South Indians firmly believe that their investment in gold will not only provide financial security in the present but will also act as a bridge to a more prosperous future. This long-term perspective, combined with a deep cultural connection to gold, reinforces the myth of gold security.

The cyclical nature of the gold market provides further reassurance. South Indians understand that while gold prices may fluctuate in the short term, they tend to rise over the long term. This cyclical pattern provides a level of consistency and predictability that other investments often lack. Consequently, South Indians see gold as a reliable means of preserving and potentially increasing their wealth over time.

Gold’s enduring reputation as a financial safe haven is tied to its intrinsic characteristics. It has no counterparty risk, meaning it doesn’t rely on the solvency or stability of any financial institution or government. This makes it an appealing option during times of economic turmoil, when other assets may lose value rapidly.

With a well-founded fear of economic uncertainty, they see gold as the ultimate insurance policy against unforeseen circumstances. Also, gold investments are not subject to the same level of market risk as stocks or real estate. The ever-present geopolitical tensions, volatile markets, and economic fluctuations only serve to reinforce their belief in gold as the safest investment.

It’s nothing but trust. South Indians trust it. They know that gold has consistently shown resilience and long-term value, making it a safe for their hard-earned money.